When buying a home, nothing could be worse than getting down to the hour of closing only to discover you don't have enough money in your account for all those insane fees you didn't know about. These fees are due to the lender and other third parties such as the title company at the close of the deal and appear on your HUD-1 settlement statement. Here’s a shortlist of the most common fees.

- Activation fee: see “Points.”

- Application fee: lenders charge a few to cover the costs of processing your loan information.

- Appraisal fee: the appraiser that completes the appraisal report receives either a fixed amount or a percentage of the property's estimated value.

- Attorney fees: if a real estate attorney coordinates the closing of the property and reviews the documentation, title examination, and a plethora of other actions, fees are due to the attorney.

- Credit report fees: during the mortgage qualification process, lenders request a credit report. The agency that creates the report charges a fee regardless of whether or not the loan actually is disbursed.

- Documentation fees. Commonly referred to as doc fees, these are the fees real estate brokerages charge for preparing documents for both seller and buyer.• Escrow deposits: during the negotiation period, earnest monies, seller payments toward closing, seller payment of property taxes (because they are paid in arrears), and prepaid private mortgage insurance monies go into a separate account established just for this transaction known as an escrow account. The escrow company releases the funds as required when the transaction completes.

- Escrow fees: the escrow company charges a fee for setting up the account, holding the monies and then disbursing them upon completion of the transaction. These fees may also include wire transfer fees, legal and document preparation fees, notary services, demand order fees, and fees for any other service provided by the escrow company.

- Flood title certification: loans on homes in certain flood zones sometimes have different requirements that require specific flood-related title searches for which there may be fees. In addition, homes located in flood zones need a policy for flood insurance, which may generate additional escrow fees.

- Inspection fees: most often, a home inspection is part of the real estate transaction. The company completing the examination charges either a flat fee or one based on the square-footage and time required to research comparable listings and prepare documentation. Either the buyer or the seller will pay the inspection fee, determined in the negotiation process.

- Loan original fees: see “Points.”

- Pest control fees: many lenders require pest inspections and mitigation before completing the loan process. Either the buyer or the seller will pay these fees, determined in the negotiation process.

- Points: In basic terms, a “point” is one percent of the total amount of a mortgage loan. Several types of points exist, but the two common to most real estate transactions are discount points and origination points. Discount points are prepaid interest a borrower may purchase to reduce interest rates on future payments. Origination fees are a percentage of the loan charged by the mortgage broker for servicing the loan. These are also known as activation or loan origination fees.

- Recording fee: the municipality that records the sale and transfer of ownership (usually the county clerk) charges a fee.

- Survey fees: if your title company required a survey to determine the exact boundaries, payment is due.

- Taxes and insurance: during closing, property taxes and homeowner's insurance fees are prorated to cover the time between closing and when the first mortgage payment comes due and collected in advance. The escrow company continues to hold these funds until payments to the government agency and insurance company come due.

- Title search and title insurance fees: a title search reviews historical records to make sure there or no liens or prior claims on the property that would preclude you buying it. Also, you pay for title insurance to protect your lender's interests in the event something was missed in the title search.

- Underwriting fees: lenders charge for processing the loan and providing it to you. This fee appears on the closing statement.

Your professional realtor can give you a good idea of what closing costs are for your purchase so that you're not in for a nasty surprise on closing day.

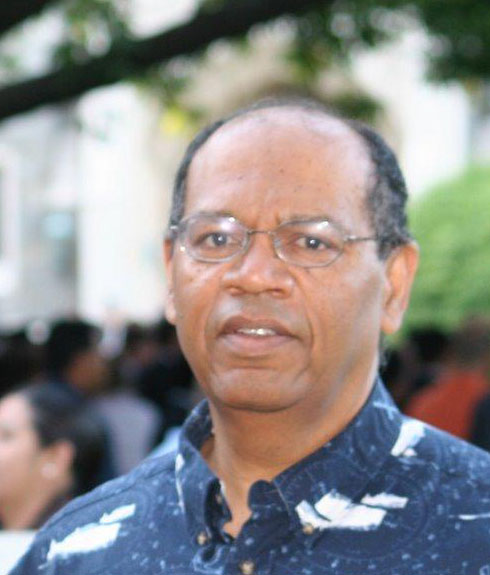

About the Author

Tom McNeill of Acorn Action

Hi, I'm Thomas McNeill and I'd love to assist you. Whether you're in the research phase at the beginning of your real estate search or you know exactly what you're looking for, you'll benefit from having a real estate professional by your side. I'd be honored to put my real estate experience to work for you.